Like anything, you normally only look at the bottom line. How much does the dreaded Taxman want from me this time?

But have you ever looked at the actual tax rates and bands you pay? And an even better question is: what are tax rates and bands?

- A tax rate is simply the percentage at which your income is taxed – this rate changes depending on how much you earn.

- A tax band (or tax bracket) refers to specific ranges of income, each subject to a different rate.

In most cases, the first portion of your income is tax-free, then you move into the lower rate tax bands, and then, as you keep earning more, you move up into the higher tax brackets. The government can change the rates, the bands or brackets and the thresholds each year in the budget.

So, even if you earn the same amount every year, your tax and the rates you pay can change from year to year.

Key Takeaways

- Different tax rates apply based on how much you earn.

- Tax bands and rates differ between Scotland and the rest of the UK.

- Income is taxed in a specific order: salary first, then savings, then dividends.

- You can reduce your tax by maximising available tax-free allowances.

- Tax bands and rates change every year, so staying updated helps you plan better.

Table of contents

1. Income tax rates and bands in the UK

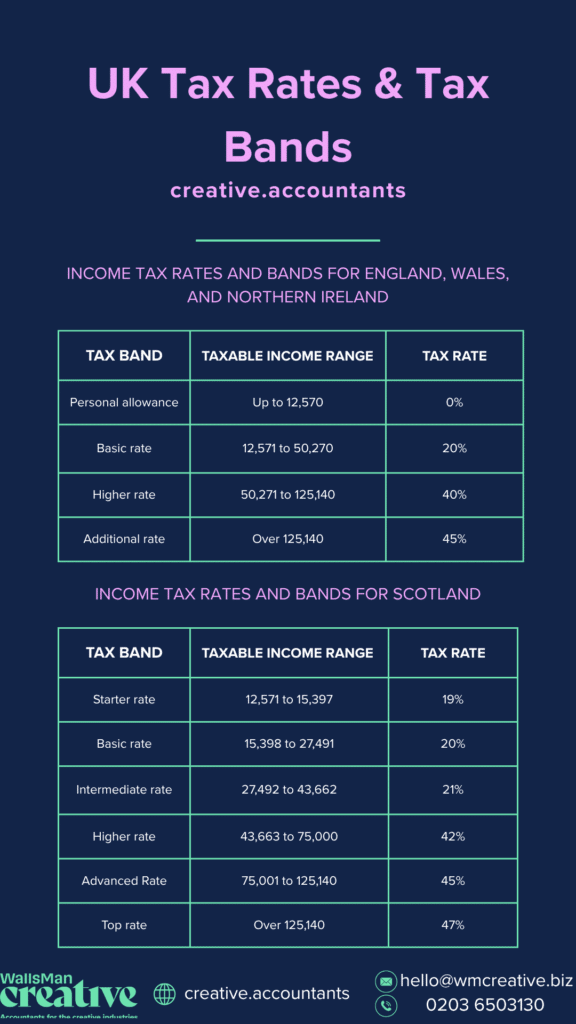

The UK operates different income tax structures for England, Wales, Northern Ireland versus Scotland. Multiple tax bands determine how much of your earnings go to HMRC.

Let’s break it down by countries!

Income tax rates and bands for England, Wales, and Northern Ireland

The current tax year is in effect until 5 April 2026.

| Tax Band | Taxable Income Range (£) | Tax Rate (%) |

|---|---|---|

| Personal Allowance | Up to 12,570 | 0% |

| Basic Rate | 12,571 to 50,270 | 20% |

| Higher Rate | 50,271 to 125,140 | 40% |

| Additional Rate | Over 125,140 | 45% |

Income tax rates and bands for Scotland

The tax rates and bands are different if you live in Scotland. The current tax year is in effect until 5 April 2026.

| Tax Band | Taxable Income Range (£) | Tax Rate (%) |

|---|---|---|

| Personal Allowance | Up to 12,570 | 0% |

| Starter Rate | 12,571 to 15,397 | 19% |

| Basic Rate | 15,398 to 27,491 | 20% |

| Intermediate Rate | 27,492 to 43,662 | 21% |

| Higher Rate | 43,663 to 75,000 | 42% |

| Advanced Rate | 75,001 to 125,140 | 45% |

| Top Rate | Over 125,140 | 47% |

Note: The Personal Allowance is reduced by £1 for every £2 of income above £100,000. This is true for the UK as a whole.

Keep in mind that these rates and bands are subject to parliamentary approval and may change – and they are changing! It’s advisable to consult the latest official resources or reach out to a financial advisor for the most current information. (If your interested in previous years’ tax rates, check HMRC website.)

You can book a free consultation call with us right here:

2. Order of taxation on different income types

First off, from a tax perspective, everyone has a personal allowance (PA). For the current tax year, this stands at £12,570. This means that the first £12,570 of income is tax free.

Secondly, it is key to recognise that different types of income have different tax rates. Income is taxed in the following order:

- Non-savings income (e.g. employment income, self-employment income, rental profits)

- Savings income (e.g. bank interest)

- Dividend income

Here’s how it works in plain terms:

1. Your regular income is taxed first

- Earnings from employment, self-employment, and rental income.

- Your personal allowance (£12,570 for most people) applies first. That means, you don’t pay tax on income up to this amount.

- Anything above this allowance falls into tax bands (20%, 40%, or 45%).

2. Your savings interest is taxed next

- If you earn interest from savings accounts (outside of Individual Savings Accounts), this comes next.

- You get a Personal Savings Allowance (PSA), so some of this income is tax-free (£1,000 for basic rate taxpayers, £500 for higher rate taxpayers, and £0 for additional rate taxpayers).

- After the allowance, savings interest is taxed at the same rates as regular income.

3. Dividends from shares are taxed last

- If you own shares in a company and receive dividend payments, these come last in the tax order.

- You get a dividend allowance (currently £500). This means the first £500 of dividend income is tax-free.

3. How to reduce your income tax?

There are legitimate ways to reduce your income tax in the UK. These legal ways can be extremely helpful for self-employed individuals and creative professionals.

What’s the key to all of this?

Well, you have to take advantage of allowances, tax reliefs, and use smart financial planning.

One of the simplest ways to reduce your tax bill is by maximising your tax-free allowances. Everyone, even self-employed individuals, employees and directors are eligible for these:

- Personal Allowance (£12,570) – This is tax-free for most people.

- Marriage Allowance – If your income is below £12,570 and your partner is a basic-rate taxpayer, you can transfer £1,260 of your unused allowance, reducing their tax by up to £252.

- Trading Allowance (£1,000) – If you earn less than £1,000 from self-employment, you don’t need to register for self-assessment or pay tax.

- Property Allowance (£1,000) – If you make less than £1,000 from rental income, you won’t pay tax.

How do you claim it?

Most allowances are applied automatically via your tax return, but you must actively apply for Marriage Allowance via HMRC.

4. Understand income tax rates and bands

Tax regulations change annually, so it’s always good to check and review the latest rates at the beginning of each tax year on April 6th. You can use a tax calculator to start with.

It’s true that online calculators can help estimate your income tax, but some complex situations which have multiple income sources, national insurance considerations, or specific tax reliefs may benefit from a professional advice.

Reach out to us if you have any questions!