How and when to report your dividends in tax return?

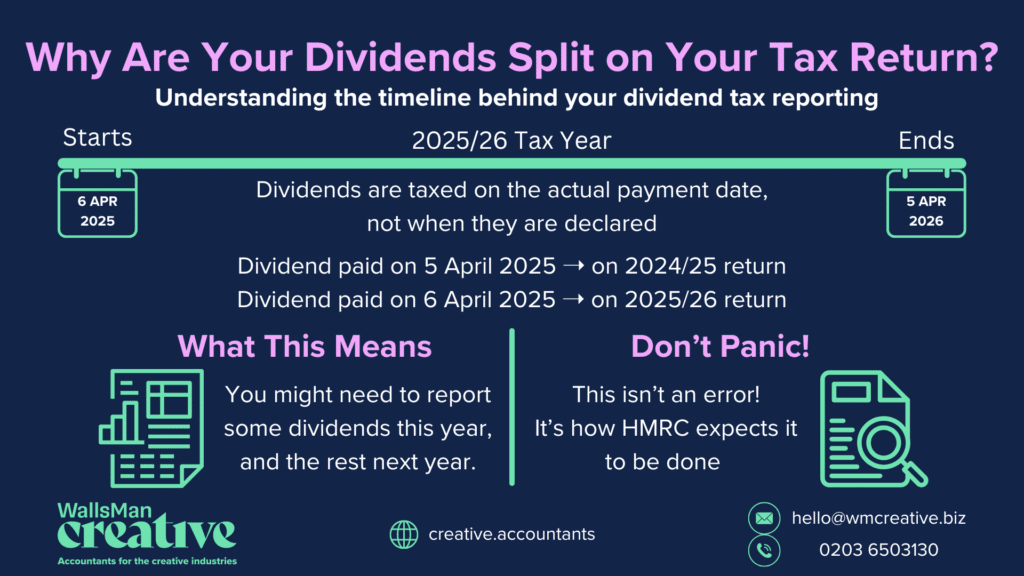

Many limited company directors get confused when dividend income seems to fall across two different tax years. HMRC treats the timing of dividends based on the date they are paid, not when they are declared.

In this blog post, we explain how to report dividend income correctly on your tax return, and why they can be split across different tax years. This guide will help you get everything right if you run your own company or hold shares elsewhere.

Creative Takeaways

- HMRC taxes dividends based on when they’re paid, not declared.

- Interim dividends are taxed when received; final dividends depend on payment date or AGM approval.

- Dividends from one company year can split over two personal tax years.

- Aligning your company’s year-end with personal tax year (31 March) simplifies reporting.

- Separate year-ends provide flexibility for strategic tax planning.

Table of contents

1. How HMRC works with tax on dividend income

This question is pretty common because it’s a common source of confusion. Dividends can show up in different tax years because of how HMRC looks at the timing of payment.

Let’s clear this confusion!

Declaration date vs payment date

HMRC doesn’t tax dividends based on when they’re declared.

It’s all about when they’re paid or become payable to you.

So, if your company announces a dividend in late March but doesn’t actually pay it until April, that income falls into the new tax year.

It doesn’t matter what’s in the board minutes or accounts, the key date is when the money is legally due to you.

Interim vs final dividends

There’s a difference in how HMRC treats interim and final dividends.

Interim dividends are declared during the year. They only count once they’re paid. They’re not fixed until the money is actually in your hands (or your bank account).

Final dividends are usually approved at the year-end or an annual general meeting (AGM). They are treated completely differently than interim dividends.

If a final dividend has a set payment date, it’s taxed in that tax year. If there’s no payment date, it’s taxed straight away.

This timing can cause your dividends to fall across two personal tax years.

Company financial year vs personal tax year

Your company’s financial year might not match the personal tax year, which runs from 6 April to 5 April.

This means your company might be paying dividends from last year’s profits, but for Self Assessment purposes, you only report dividends in the tax year you received them.

That’s why it’s not unusual to see dividends from one company accounting period end up in different tax years on your personal return.

2. How to pay tax on dividend income on personal tax year

As a director, you need to file a personal Self Assessment tax return each year. The UK personal tax year runs from 6 April to 5 April.

Let’s say your company paid you four dividends during the year: August, December, March and May.

For your personal return:

- The August, December and March dividends would fall into the same personal tax year.

- The May dividend would fall into the next personal tax year, because it was paid after 5 April.

What exactly does this mean?

If you analyse the dividends paid, you can see that not all the dividends you receive in a company’s financial year will necessarily land in the same personal tax return.

3. How dividends are taxed on company accounts

Your company has its own financial year, which starts on the date of incorporation and runs for 12 months. So, if you set up your company on 7 June, its financial year would run to 30 June each year.

In your company’s annual accounts, all four dividends paid (August, December, March, May) would be included, because they all occurred before the company’s year-end on 30 June.

But!

Remember: while the company accounts record all these payments in the same financial year, your personal tax return may split them over two different tax years, just like the previous example illustrated that.

4. Dividends in tax return: align or keep them separated?

Some directors choose to change their company year-end to 31 March. This brings it in line with the UK personal tax year. This move can make things simpler, because you can follow the same cycle every year.

But others prefer to keep different years. Why?

Well, this offers more flexibility and it can open up other tax planning opportunities. You can spread dividend payments across two personal tax years, and this can help you stay within the dividend allowance or avoid a higher tax band in one year.

The truth is: there’s no one-size-fits-all answer. It depends on your personal goals, how predictable your income is, and whether you prioritise simplicity or want to plan more strategically.

HMRC also publishes guidance on how to pay tax on dividend income, including when and how it’s taxed, how much tax you’ll pay, and how it fits in with your other income from savings.

But if you find it all a bit unclear – which we totally understand – you can always speak to your accountant… or get in touch with us! We’re here to help you make sense of it all.