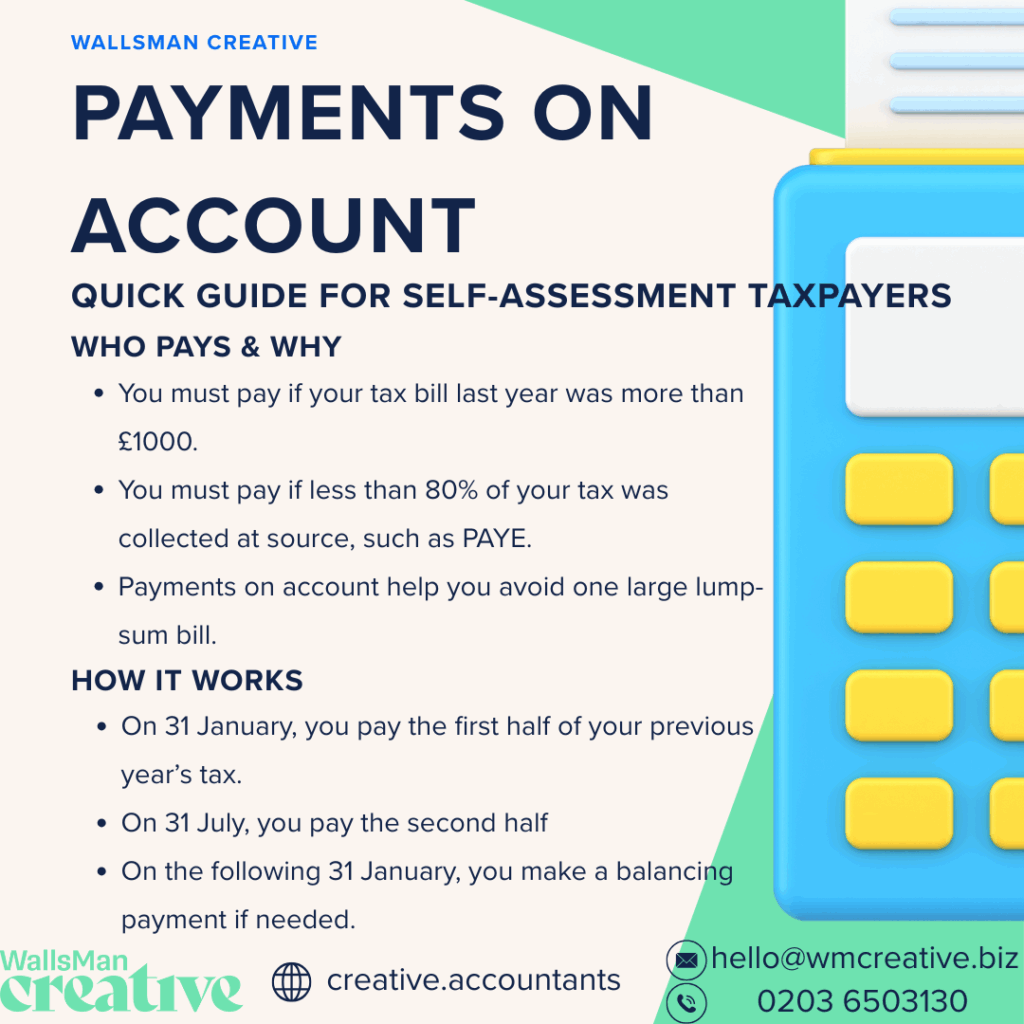

Payments on account (POA) are advance payments you make towards your Self Assessment tax bill.

If you are self-employed or have other income not taxed through PAYE, you may need to make these payments.

They help HMRC collect tax throughout the year, rather than waiting for one large payment at the end.

The amount you pay is based on your previous year’s tax bill. You make two payments each year:

- one by 31 January and

- one by 31 July.

Each payment is usually half of your previous year’s tax bill. If your actual tax bill is higher than expected, you make a balancing payment the following January.

Payments on account can feel like an extra bill, but they help you spread the cost of your tax. They are a normal part of the Self Assessment system and help avoid large bills at the end of the tax year.

Creative Takeaways

- Payments on account are advance payments made towards your Self Assessment tax bill.

- They apply if your previous year’s bill was over £1,000 and less than 80% of tax was collected at source.

- You must make two payments each year: one by 31 January and one by 31 July, each usually half of the previous year’s bill.

- A balancing payment is due the following 31 January if your actual tax bill is higher.

- Missing deadlines results in interest charges and penalties from HMRC.

- You can reduce payments if your income drops by applying online or submitting form SA303.

Table of contents

1. Who needs to make payments on account?

Payments on account apply to people who use the Self Assessment system.

This includes self-employed individuals, sole traders, freelancers, and others with untaxed income. You will need to make payments on account if your previous year’s tax bill was over £1,000, and less than 80% of your tax was collected at source, such as through PAYE.

For example, if you are self-employed, you likely pay all your income tax through Self Assessment.

Let’s say your tax bill last year was £3,000. HMRC expects you to pay half of that (£1,500) by 31 January, and the other half (another £1,500) by 31 July. These payments go towards your tax for the current year.

If you have other untaxed income (rental income or investments), you may also need to make payments on account.

But…

Not everyone needs to make these payments!

If your tax bill was less than £1,000, or if most of your tax is already deducted at source, you will not be asked to pay on account.

What’s the purpose of payments on account, you ask?

Well, they help you spread the cost of your tax bill. You still need to prepared to make these payments because they can catch some people off guard.

2. How do payments on account work?

Payments on account are based on your tax bill from the previous year. HMRC uses that figure to estimate how much tax you are likely to owe in the current year.

You make two equal payments each year – already mentioned in this article:

- 31 January: First payment, equal to 50% of your previous year’s tax bill

- 31 July: Second payment, also 50% of your previous year’s tax bill

How does this work in real life?

For example, if your tax bill for the last tax year was £4,000, you would pay £2,000 by 31 January and £2,000 by 31 July.

At the end of the tax year, you file your Self Assessment tax return. If your actual tax bill is higher than the payments you have made, you will have to make a balancing payment. This payment is due by 31 January in the following year.

In case your tax bill turns out to be lower, HMRC will adjust your account. You may get a refund or a credit towards future payments.

Balancing payment to HMRC

A balancing payment is the extra amount you owe to HMRC if your actual tax bill is higher than the payments you’ve already made on account.

If you paid £4,000 through payments on account but your actual tax bill is £5,000, you’ll need to pay a balancing payment of £1,000.

When your payments on account covered your full tax bill, no balancing payment is needed.

Missing a deadline with HMRC payment

Missing either deadline can result ininterest charges and penalties from HMRC. The interest starts from the day after the payment was due, so even a short delay can add extra costs.

Things can get rough sometimes. We understand. HMRC might not. So, if you can’t afford to pay, contact HMRC as soon as possible.

You may be able to set up a Time to Pay (TTP) arrangement to avoid penalties and reduce the risk of further charges. But let’s examine this late payment in details.

| Creative Tip Planning ahead is key. Make sure you know the dates and set reminders to avoid missing deadlines. |

3. What if you can’t afford payments on account?

If you can’t afford your payments on account, you have a few options to help manage your tax.

If your income is likely to drop compared to the previous year, you can apply to reduce your payments. This can be done online through your HMRC account or by filling in the SA303 form.

Be careful, though!

If you reduce your payments too much and your actual tax bill is higher, HMRC will charge you interest on the shortfall. You have make sure you have a good reason for reducing your payments, so only do this if you have a fall in income or business profits.

When you are unable to pay at all, contact HMRC!

You can ask for a Time to Pay arrangement which allows you to spread your payments over a longer period – usually through monthly installments.

Don’t ignore the problem. Admit it you have a problem, and act early!

HMRC is more likely to agree to a payment plan if you get in touch with them before the deadline.

4. Reduce your payments on account with WallsMan Creative

Payments on account are a standard part of the UK tax system.

But they can still catch you by surprise.

Payments on account help spread the cost of your tax across the year, but if you’re not prepared, they can feel like an unexpected burden. Managing your taxes is easier if you’re prepared for all of these things:

- how payments on account work

- who needs to pay

- what happens if you can’t afford them.

If you’re in the creative sector and need help with your tax, we’re here for you!

At WallsMan Creative, we breathe and understand the creative industries: our team knows the pressures you face, and we’re ready to support you. To us, it doesn’t doesn’t matter if you need help with payments on account, Self Assessment, or even financial forecasting.

Get in touch today.

Let’s take the stress out of tax, so you can focus on what you do best: creating.