How Making Tax Digital for Business Works (and What You Need to Do for MTD)

Making Tax Digital for business means you must keep digital records and send tax updates to HMRC using software. It changes how your business handles

Making Tax Digital for business means you must keep digital records and send tax updates to HMRC using software. It changes how your business handles

Making Tax Digital for self-employed means you keep business records and submit tax information using digital tools instead of paper forms. The government set up

Making Tax Digital (MTD) software helps you meet HMRC’s requirements for digital tax reporting. It replaces manual tax returns with digital records and direct submissions.

Selling to EU from UK has changed quite a bit after Brexit. UK businesses are no longer part of the EU’s single market and customs

MTD stands for Making Tax Digital. And as of things stand, you’ll need to prepare for MTD for income tax sooner or later. It’s a

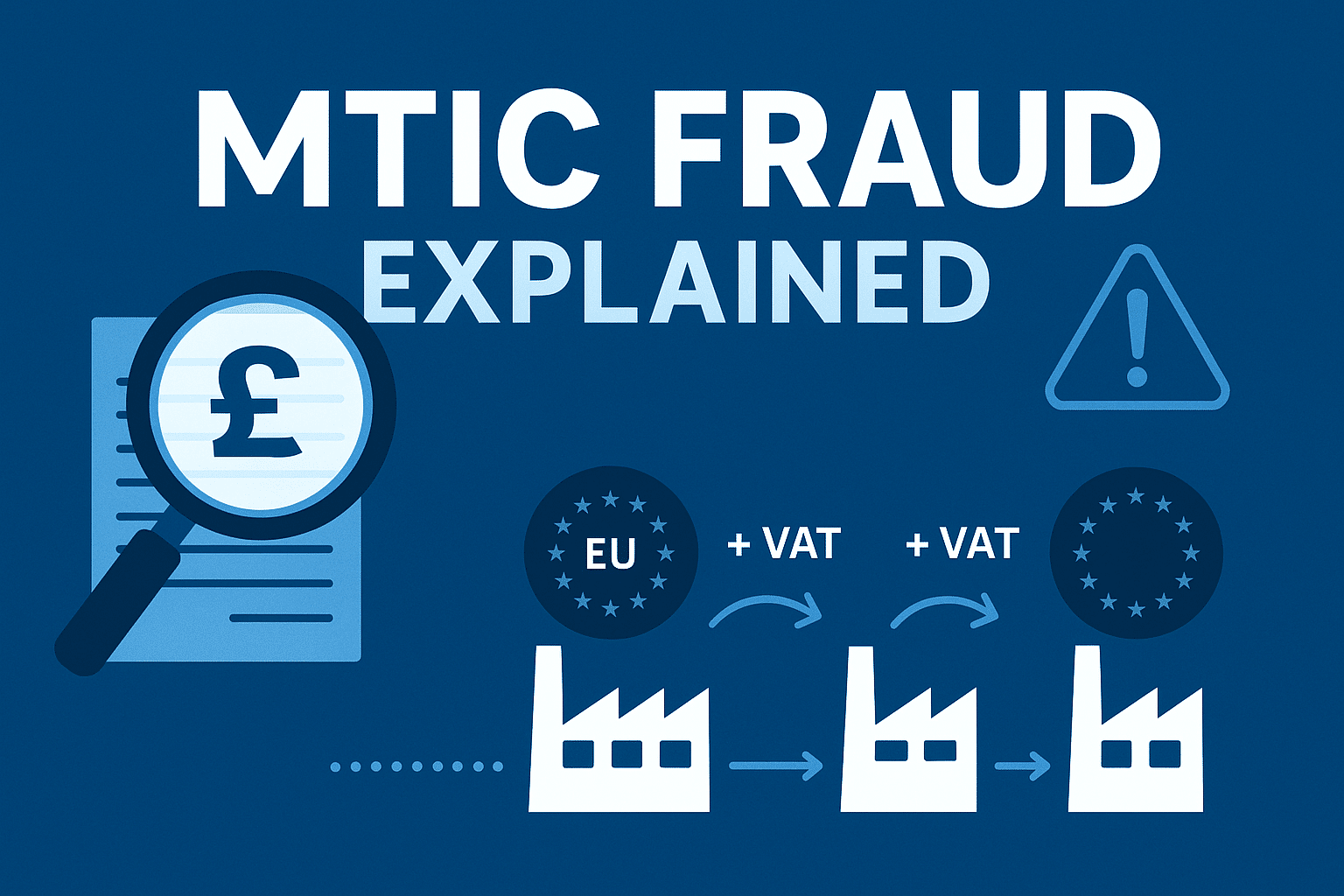

MTIC fraud (short for Missing Trader Intra-Community fraud) is a type of VAT fraud that happens when businesses exploit rules on cross-border trade within the

An EMI scheme (Enterprise Management Incentive) is a tax-advantaged share option plan used by UK companies. The scheme lets businesses grant selected employees the right to

Taxable benefits are non-cash rewards or payments that have a value and are treated as part of your income. What are taxable benefits? These can

Tax returns can be hard work but sometime, especially in today’s business climate it’s finding the cash to pay the tax that can be the biggest problem.

KPIs, or Key Performance Indicators, are clear measurements that show how a business is doing. They help you track progress in different areas: But what

020 3650 3130

WallsMan Creative Ltd. Reg In England 09471697. Reg Office. Unit 14, Princeton Mews, 167 London Rd, Kingston, KT2 6PT.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |