Pre-registration expenses for VAT are a specific set of expenses you can claim within a certain time period of registering your business.

There is some scope to reclaim VAT on goods and services your business bought before registering for VAT. You will only be able to do this if you have the VAT invoices for such purchases.

This reclaim is often a valuable means of funds in the earlier periods of trade so it is definitely worth looking into.

Key Takeaways

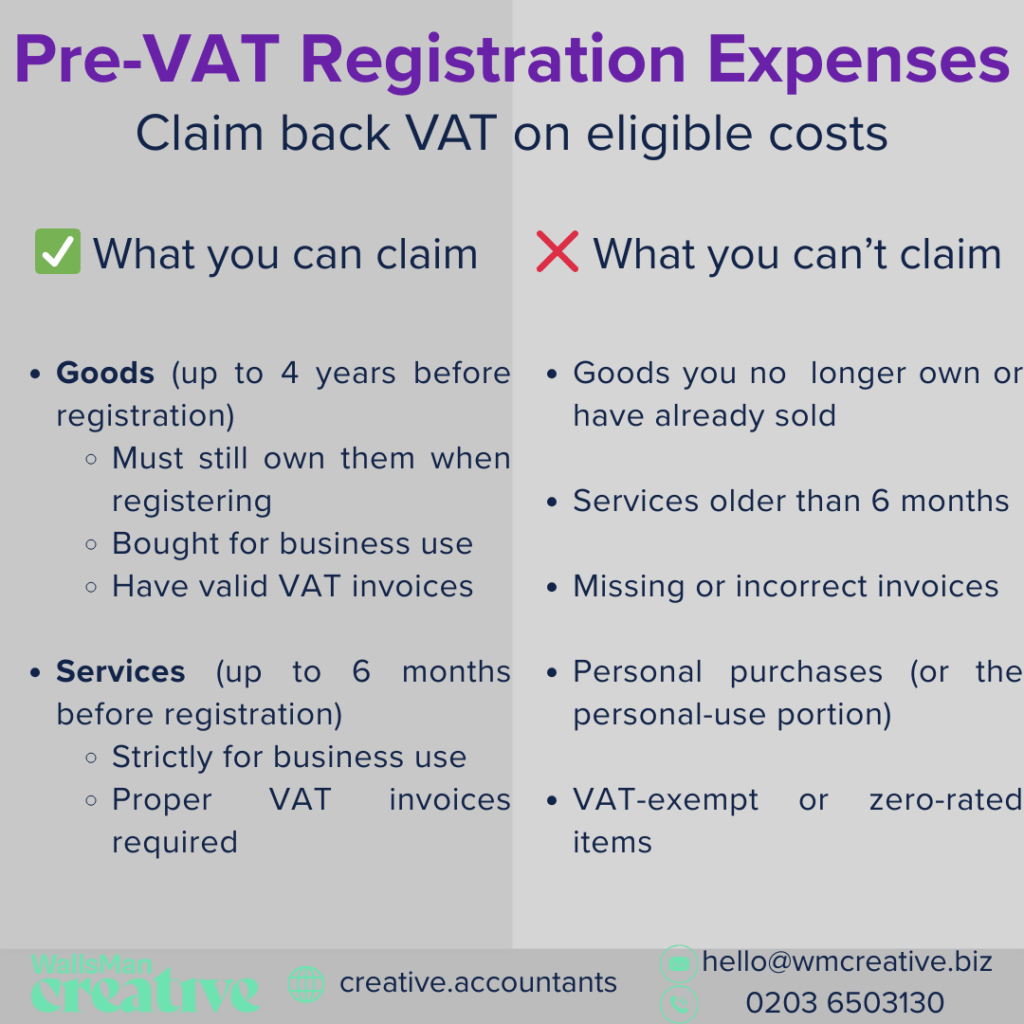

- You can claim pre-VAT registration expenses, going back 4 years for goods and 6 months for services used for your business.

- Keep VAT invoices and receipts, as proof is essential for making valid claims.

- Expenses must be strictly for business use – personal purchases are not eligible for VAT reclaims.

- For goods, you must still own them at the time of VAT registration to be able to reclaim the VAT.

- You can reclaim this VAT on your first VAT return, which can boost your cash flow early on.

Table of contents

1. What are pre VAT registration expenses?

Pre VAT registration expenses are business costs that you paid for before officially registering for VAT but may still be eligible to reclaim VAT on.

Many creatives – freelancers, artists, designers, filmmakers etc.) – start their businesses by purchasing equipment, software, or other professional services before reaching the VAT registration threshold.

The good news is that HMRC allows you to claim back VAT on certain pre-registration expenses. There are certain conditions you have to meet. One of the most important condition is that the expenses must have been used for your business.

You need to have a valid VAT invoice as proof.

There are specific rules around how far back you can claim VAT, depending on whether the cost was for goods (like a camera, laptop, or stock) or services (such as accounting fees or website design).

If you want to double-check these specific rules with us, you can book a call for free – and we’ll reach out to you in no time!

2. How long can you reclaim your pre-registration VAT expenses?

Generally speaking, you can claim VAT on goods you bought up to 4 years prior to the date of registration, and services you bought up to 6 months prior to the date of registration.

However, there are a set of conditions that need to be met:

Entitled to claim VAT for goods

You can reclaim VAT on goods purchased up to four years before registering for VAT, as long as:

- You still have the goods at the time of registration.

- They were bought for business use.

- You have valid VAT invoices.

If you bought a professional camera three years ago and are still using it for your business when you register for VAT, you can reclaim the VAT you originally paid on it.

Entitled to claim VAT for services

VAT on services can be reclaimed for up to six months before your registration date, provided that:

- The services were for business use.

- They were not related to goods you no longer have.

- You have proper VAT invoices.

If you hired a web designer five months before VAT registration to create your business website, you can reclaim the VAT charged on their services.

3. When you can’t claim VAT on pre-registration expenses

While HMRC allows you to reclaim VAT on certain pre-registration expenses, there are specific situations where you cannot claim:

- If you bought goods before registering for VAT but no longer have them in your business when you register.

- Any services purchased before the 6-month period do not qualify for VAT recovery.

- If the invoice is missing, incorrect, or doesn’t show VAT separately, HMRC will not allow the claim.

- If an item was bought for personal use, or for both personal and business purposes, only the business portion may be claimed (if applicable).

- If you purchased goods before VAT registration and have already sold them before becoming VAT-registered, you cannot reclaim the VAT on those costs.

- If your business sells VAT-exempt products or services, you may not be able to reclaim VAT on related purchases. Also, if an item was zero-rated (e.g., some books or children’s clothing), no VAT was paid in the first place, so there’s nothing to reclaim.

In a hypothetical situation, if you purchased a laptop two years ago, but it broke or was sold before your VAT registration, you won’t be able to claim back the VAT. It doesn’t matter that you still have the invoice, and it’s still in the 4-year time period, because you sold it before becoming VAT-registered.

4. How to claim pre VAT registration expenses?

In order to claim pre-registration VAT on goods and services you must have valid VAT invoices for each item that you are claiming for. The pre-registration expenses should be reclaimed on your first VAT return.

Reclaiming pre-registration VAT could give your creative business a valuable cash boost. Remember the key timeframes: 4 years for goods you still own and 6 months for services.

Keep those VAT invoices safe, make your claim on your first VAT return, and focus on business-related expenses only.

Do you need help with all of this? Our team specialises in supporting creatives like you. We’ll ensure you reclaim everything you’re entitled to while staying HMRC-compliant.

Ready to put that money back into your creative work? Let’s talk about how we can help.