Key Takeaways

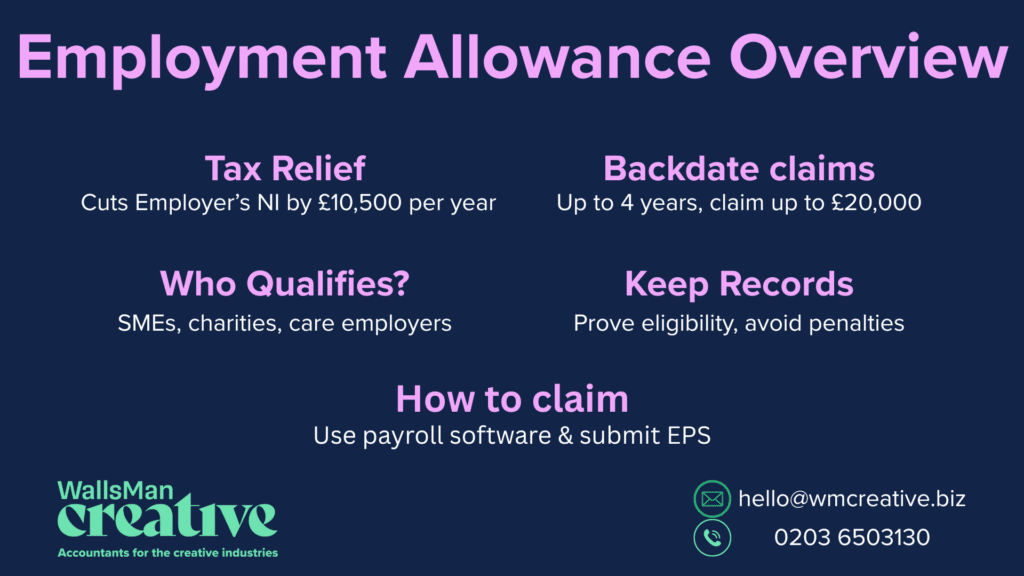

- Employment Allowance lets eligible UK employers reduce their Employer’s National Insurance liability by up to £10,500 each tax year.

- Most small businesses, charities, community amateur sports clubs, and employers of care workers can claim the allowance.

- You must claim Employment Allowance each tax year, usually via payroll software by submitting an Employer Payment Summary (EPS).

- You can backdate a claim for up to four years, potentially recovering significant refunds.

- You must keep clear records to prove eligibility and avoid HMRC penalties.

Previously, employers could only claim if their Class 1 National Insurance liability was below £100,000. From 6 April 2025, this £100,000 cap has been removed. Once claimed, the allowance is applied automatically through payroll until the limit is reached or the tax year ends.

Table of contents

1. What is employment allowance?

In more professional terms: employment allowance is a government scheme that helps small businesses and charities save money by reducing their National Insurance bill.

If you’re an employer, you normally have to pay National Insurance on your employees’ wages. But the employment allowance allows you to cup up to £10,500 off that cost each tax year.

The good thing is: it works automatically!

Once you claim it through your payroll system, the employment allowances lower what you owe. This continues until you use the full amount or the tax year ends.

Basically, this scheme allows a company to write off the first £10,500 of its overall employers NIC bill each year. National Insurance is similar to income tax. It helps pay for state benefits when people need support. This includes times when someone is unemployed, sick, retired, or grieving.

2. What is employer’s National Insurance?

Employer’s National Insurance is a tax that businesses in the UK must pay when they employ staff.

It’s a percentage of each employee’s wages, paid on top of their salary.

This money goes towards things like the NHS, state pensions, and other government benefits. It is the employer’s payment to the National Insurance system. This payment helps fund public services.

To explain it simply, let’s see an example:

You run a small business and hire someone (let’s say her name is Sarah). Sarah earns £30,000 a year.

As her employer, you need to pay National Insurance on her wages, but only on the amount above £5,000. This means you’re taxed on £25,000 of her salary.

The current rate for Employer’s National Insurance is 15%, so you’d pay around £3,750 over the year. This, of course, isn’t taken from Sarah’s wages – it’s an extra cost for your business.

And this is the part that contributes to things like the NHS and state pensions.

The secondary threshold is currently set to £5,000. Employers will pay NIC on earnings above £5,000. The rate has also increased from 13.8% to a rate of 15% from April 6, 2025.

3. Are you eligible for employment allowance?

Most employers with a liability to pay employer (Secondary) NIC are eligible. But determining your eligibility for the employment allowances is all about assessing your business structure and activities.

Who can claim employment allowance

- Sole Trader and Partnerships: employing staff and paying Class 1 NICs.

- Charities and those with charitable status (schools, academies and universities): even if involved in public sector work

- Community Amateur Sports clubs (CACs)

- Limited Companies: with multiple employees

- Employers of care or support workers: if you help someone who needs care, it could be due to old age, a mental or physical disability, an illness, or substance dependence.

Who cannot claim employment allowance

- Single-employee Limited Companies: you cannot claim if you are a limited company where the director is the only employee (Single director company) paid above the Secondary Threshold.

(If however, you are a limited company with two or more directors, where all are paid above the secondary threshold, then the company is eligible to claim the employment allowance for the whole tax year.)

- Public Sector Organisations: entities where more than half of the work is in the public sector (e.g. local councils, NHS services)

- Employers of Domestic Staff: if you employ someone for personal, household work (nanny, gardener)

4. How to claim employment allowance in 4 steps

You can claim employment allowance through different methods. It is easy through your payroll system.

- Use your payroll software: most of these software have options to claim employment allowance.

- Submit an EPS (Employer Payment Summary): your software will send an EPS to HMRC to confirm you’re claiming the allowance

- Automatic deduction: HMRC then processes your claim, and the allowance is automatically applied to your NIC.

- Reclaim each tax year: you must claim the employment allowance every tax year; it doesn’t roll over automatically.

And that’s it! Pretty simple, right?

Of course, if you’re lost in all of this, or you don’t want to handle this yourself, you can always reach out to us, and we’ll set it up for you. This way, you can focus on what really matters to you: your creative challenges.

5. Backdate employment allowance claims up to 4 years

What happens if you forget to claim your employment allowance?

Don’t worry! You’re in luck!

You can backdate your employment allowance claim by up to four tax years. So, even if you forget, you can recover significant amounts in savings.

How does this work in practice?

If you missed claiming it in previous years, you can retrospectively apply and you can receive a refund for the NI contributions you overpaid.

The potential backdate could look like this (if you apply now):

| Tax Year | Maximum Allowance |

|---|---|

| 2024/25 | £5,000 |

| 2023/24 | £5,000 |

| 2022/23 | £5,000 |

| 2021/22 | £4,000 |

If you’re eligible for all four years, that’s a total of £19,000 in refunds.

The setup works the same way as if you were to apply the first time: you check your eligibility, use payroll software (or HMRC tools), send an EPS, request a refund.

6. How to stop claiming employment allowance in 4 steps

There can be reasons as to why you would want to stop claiming employment allowance.

What do you do then?

Well, you need to go over the process one more time, but this time, you have to do things a bit different.

- Update payroll software: remove the employment allowance claim

- Submit an EPS: send an EPS where you select the option to withdraw your claim for the current tax year

- Submit to HMRC

- Pay any outstanding NI contributions: once you stop claiming, your employer’s National Insurance contributions will go back to normal, so you have to cover the full NI bill going forward.

7. Keep your records!

As always: it’s important to keep your records about employment allowance.

HMRC can check on you anytime to see if you’re eligible to claim it. Maybe you were under the threshold in previous years – you need to prove it. Maybe you weren’t part of a connected company group – you need to prove it.

Maybe HMRC finds that you claimed the allowance incorrectly – detailed records can help defend your claim in case of an audit.

Since our company works with creatives, we totally understand it’s hard to keep up with all of this. And that’s why we’re here: you can request a one-hour free consultation and we’ll listen to your problems, so we can solve it together.