A government gateway account is an online login that lets you access and manage UK government services.

The government gateway account is a secure key to your HMRC account, where you can handle your taxes:

- File tax returns (Self Assessment, VAT, Corporation Tax, SA302)

- Make tax payments (and check if you owe anything)

- Manage PAYE (if you employ staff)

- Check your National Insurance record

- Get messages from HMRC about deadlines or tax updates

If you are new to this, you might ask: how to create a government gateway account. This guide will guide you through it.

Creative Takeaways

- Gateway Account – Access and manage HMRC services.

- User ID – Essential for tax and filings.

- Add Taxes – Self Assessment, VAT, PAYE.

- Recover ID – Use email or HMRC support.

- Stay Secure – Save details, enable 2FA.

Table of contents

1. How to create a government gateway account: step-by-step guide

To create a government gateway account, you have to follow these steps:

Go to the Official HMRC website

1. Visit the official website here: HMRC online services – read through the guidelines as to what the government gateway has to offer.

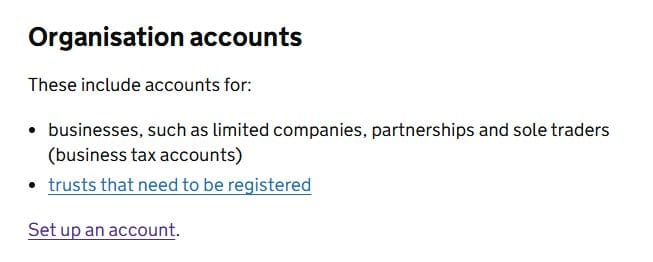

2. Click on ‘Set up an account‘ under ‘Organisation accounts’.

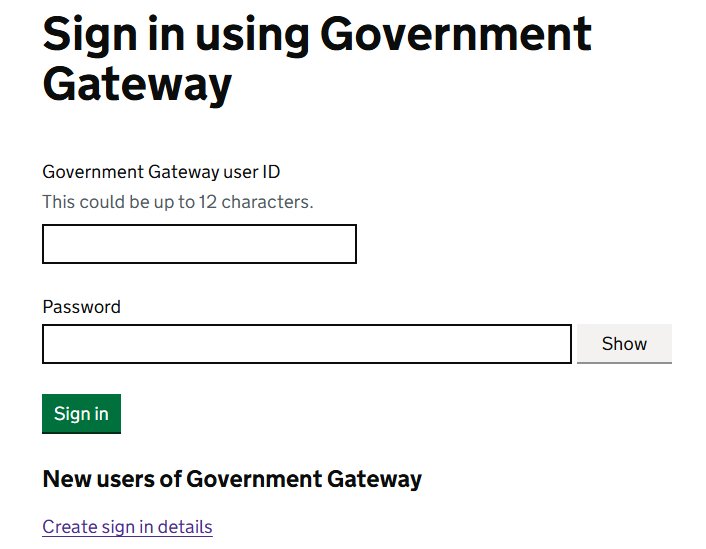

3. On the government gateway page, click on ‘Create sign-in details‘ since you are a new user.

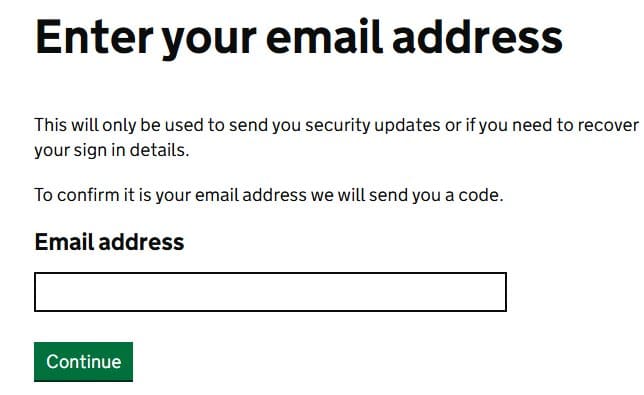

Provide your email address

4. Enter your email, and you’ll receive a security code.

5. Enter the code to verify your email.

Set up your login details

6. Choose a password – make sure it’s secure.

7. HMRC will give you a Government Gateway User ID – write this down!

Add security verification

8. Choose how you want to receive security codes (SMS, authentication app).

9. Enter your phone number and verify it with the code sent.

Provide personal or business information

This section depends entirely upon you. You can set up information for:

10. Individuals (Self Assessment, PAYE) – enter your name, NI number, date of birth.

11. Businesses (VAT, Corporation Tax, PAYE for employers) – enter your business details like your company registration number or Unique Taxpayer Reference (UTR).

Register for HMRC service

12. Choose which services you need – Self Assessment, VAT, Paye

13. HMRC may send an activation code by post – this can take up to 10 days (21 days if you live abroad)

14. Log in and enter the code to activate your services

And that’s it! In only 14 steps, you have your government gateway account with your government gateway user ID.

| Creative Tips Please note down your User ID and password as losing this ID can create problems in the future (not to mention if you lose it moments before a deadline you may receive a late payment penalty). |

2. What is a government gateway User ID?

In the previous section, I mentioned the government gateway user ID.

The Government Gateway User ID is a unique, 12-digits number that lets you securely access HMRC online services.

It allows you to:

1. Log into HMRC services

2. Submit tax returns and make payments

3. Track tax liabilities

4. Manage tax codes and National Insurance records

5. Authorise accountants or agents to handle tax affairs on your behalf

Without your government user ID, you can’t access HMRC’s online services. You’ll also need the user ID to register for new tax services.

3. How to add your taxes to your government gateway account

You can do a lot of useful things with your new User ID and account. With it, you can manage and submit returns for different types of tax.

How do you do that?

Log in to your government gateway account

- Go to https://www.gov.uk/log-in-register-hmrc-online-services.

- Enter your Government Gateway User ID and password.

- Complete two-step verification if prompted.

Go to ‘Manage Account’

4. Once logged in, look for ‘Manage Account’ or ‘Services you can add’.

Choose the tax you want to add

5. Select the tax service you want to register for, such as:

-

- Self Assessment (for freelancers, sole traders, and landlords)

- VAT (for businesses over the VAT threshold or voluntary registration)

- PAYE for Employers (if you employ staff)

- Corporation Tax (for limited companies)

- Customs & Import Duties (if you trade internationally)

Enter required details

6. Depending on the tax you’re adding, HMRC may ask for specific details:

- Self Assessment: Unique Taxpayer Reference (UTR) and National Insurance Number.

- VAT: VAT registration number and business details.

- Corporation Tax: Company Registration Number (CRN) and Unique Taxpayer Reference (UTR).

- PAYE for Employers: Employer PAYE reference.

Start managing your taxes online

7. Once activated, you can file tax returns, check payments, and manage your tax affairs.

4. What to do when you have a forgotten Government Gateway ID?

If you’ve forgotten your Government Gateway ID, don’t worry! Keep your calm, and look for one of the following solutions.

There are several ways to recover it.

- The easiest method to retrieve it is by visiting the HMCR login page.

- Click on ‘Forgot user ID’.

- You’ll be asked to enter the email address linked to your account.

- HMRC will send your User ID to that email.

Tip: Check your spam or junk folder if you don’t see it in your inbox.

- You can recover your User ID using your personal details.

- On the login page, select ‘Recover using personal details’.

- Enter relevant information:

- For individuals: National Insurance number

- For Self Assessment: Unique Taxpayer Reference (UTR)

- VAT registration number

- For businesses: Company Registration Number

- If all details match, you should be able to recover your user ID.

Now, there might be a cases where you can’t recover it online. In these instances, you have to contact HMRC Online services:

- You can reach them at 0300 200 3600 for Self Assessment or

- 0300 200 3700 for Corporation Tax and VAT.

Phone lines are open Monday to Friday, usually between 8 AM and 6 PM.

If you still do not have your Government Gateway user ID or password, you will need to create a new Government Gateway account.

Still, the best practice is to avoid losing your government gateway user ID. Save it in a secure place. If you’re unsure which email you used, try checking multiple accounts for previous HMRC email.

If you have any questions, or you’re unsure about the whole process, book your free one-hour consultation with us, and we’ll guide you through the process.