Accounting for government grants became a thing after the devastating impact of Covid-19. While grants used to live in the realms of the charity and culture, over the past couple of years, we’ve seen government grants being issued to many groups of people.

A common question we get is – how does accounting for government grants truly work?

All grants come with their own terms and it’s important that you understand the term of the grant which you have received.

So, let’s dig deeper and find out how to record grants, and how accounting for government grants works.

Creative Takeaways

- Recognise grants properly – Only when conditions are met.

- Choose an accounting method – Deferred income or deduct from asset cost.

- Revenue vs. Capital Grants – Revenue = income, Capital = asset adjustment.

- Financial statements – Disclose grant details and impact.

- Follow IAS 20 / FRS 102 – Stay compliant with regulations.

Table of contents

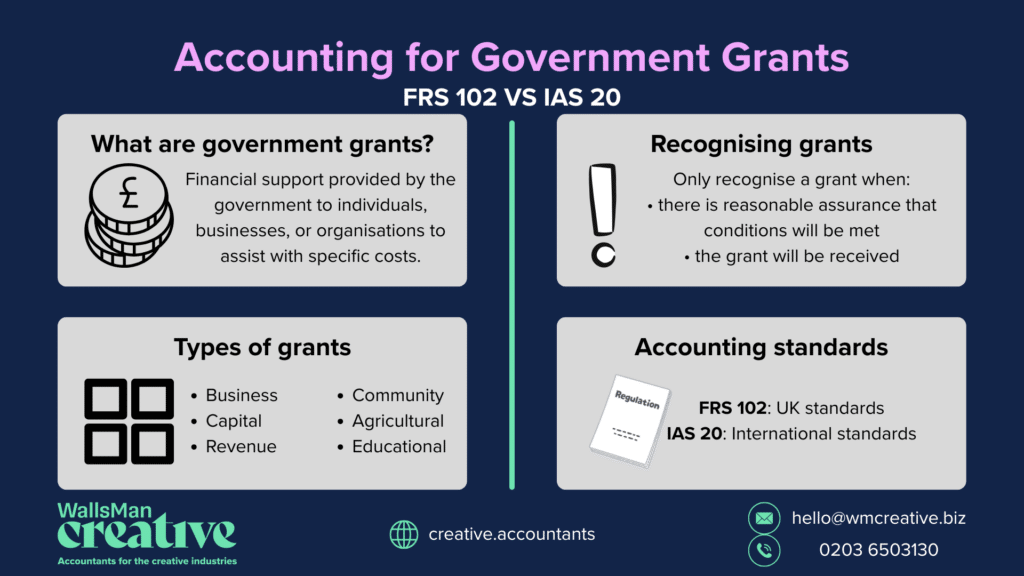

1. What are government grants?

First of all, we need to get this question sorted out: what are government grants?

Government grants in the UK are financial support provided to you (individual), businesses (partnerships, LTDs), or other types of organisations (charitable). The government grants are given to help with specific costs.

Just as I mentioned in the introduction, they became -understandably – popular during the Covid-19 pandemic.

BUT!

There are numerous other costs that these grants could cover. Just a list a few of these:

- starting a business

- buying equipment

- hiring staff

- funding research

- funding development

Since all of these grants serve different purposes, there are different types of them, too. Let’s check some of these in the next section!

2. Different forms of government assistance

Some government grants help individuals and businesses with day-to-day expenses (wages, training costs), while other types help in the longer term (buying machinery or property).

Most of these government grants come with certain terms and conditions (and for God’s sake, read these ones, not like when you agree to them on your computer) that need to be fulfilled and must be accounted properly – more on that later!

For now, let’s go over these different types of grants one-by-one, in just a few words.

Business grants

Simply put, business grants help businesses grow, innovate or create new jobs. They are the most general versions of government grants.

They can be start-up grants, innovations grants, export grants or even sustainability grants. Some of the most popular ones include:

- The King’s Trust (formerly known as The Prince’s Trust) – for young students or entrepreneurs

- Innovate UK Smart Grants – support for research and development

- UK Export Finance – help for international expansion

Capital grants

These are for purchasing assets like equipment, buildings, or vehicles – if you need them for business purposes:

- Green Energy Grants – support for energy-efficient upgrades

- Manufacturing Grants – help businesses improve production with new machinery

Revenue grants

The name says it all: revenue grants cover operating expenses, like internal trainings, wages, or marketing:

- Apprenticeship Grants – funding to support hiring apprentices

- Skills Bootcamps – help with staff development and upskilling

Community & social enterprise grants

Community & social enterprise grants typically offer support for non-profits, charities, and social enterprises:

- The National Lottery Community Grant – funding for community projects

- Arts Council Grants – help for creative and cultural initiatives (closest to our hearts <3)

Agricultural & rural business grants

Agriculture is also an important sector, so no wonder these grants are popular – not just in the UK, but all over the world. They improve sustainability and productivity for farmers and rural enterprises:

- Farming Investment Fund (FIF) – support for modernising farming equipment

Education & skills grants

Government grants can also support students, schools, and educators. So, they’re not always aimed at smaller businesses but also individuals, or other types of organisations:

- Student Grants – financial aids for pupils and students

- Teacher Training Bursaries – incentives for becoming a teacher

I only listed some of the most popular government grants, but keep in mind that there are other types of grants available – one is possibly waiting for you, too!

They are often managed not just by the government, but by local councils or industry groups. So, keep an eye out, and apply when you can. 😉

3. Do you have to account for government grants?

Short answer: yes.

Longer answer: well, it all depends on what kind of grants you receive. Grants are income, and you must account them properly in your financial records.

Depending on the terms of the specific grant there are different ways to account for what you have received. However, the most common is as income. Usually you will receive some form of funds and that will be spent in the delivery of some product, service or function.

To keep the grant separate from your normal trading revenue it is usually posted to ‘other income’.

This is so that its easy to identify by you and others looking at the accounts.

4. How to account for government grants in the UK: FRS 102 or IAS 20?

There are two main ways to account for grants under UK Standards (FRS 102) and international standards (IAS 20).

And, there are also two models to recognise these grants:

1. Performance Model (FRS 102)

- recognise the grant as income immediately if you meet all grant conditions

- if conditions are unmet, defer the recognition until they are met

2. Accrual Model (FRS 102 & IAS 20)

- revenue grants – recognise as income over time in line with related costs

- capital grants – deduct from the asset cost OR recognise as deferred income and release it to the income statement over the asset’s useful life

You also have to record the grants properly in your accounts and there are also some required disclosures you must make:

- Accounting policy adopted for grants, including method of balance sheet presentation

- Nature and extent of grants recognised in the financial statements

- Unfulfilled conditions and contingencies attaching to recognised grants

I know, I know…

This is slightly confusing for many people so you may want to ask your accountant to help you make sure the grant is posted correctly and disclosed in line with reporting requirements.

If in doubt… you can always reach out to us. We specialise in helping with accounting for the creative industries, and since creatives are really good at applying to these grants, we know all the ins and outs.