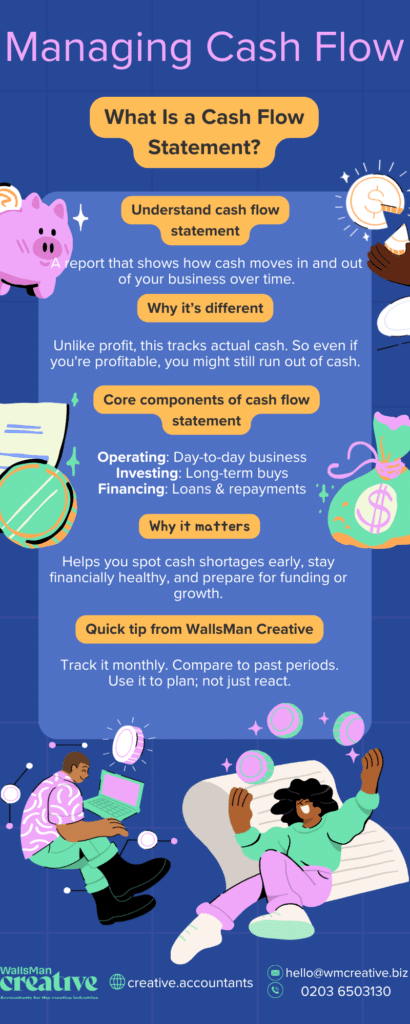

A cash flow statement tells you how much cash is entering and leaving your businesses. Along with balance sheet and income statements, it is one of the three most important financial statements for managing your small business.

The cash flow statement is essential to understand liquidity, to see if you have enough cash to cover expenses, and to assess your financial health.

When a company has more cash at the end of the period than it did at the beginning of the period, the business has a positive cash flow. ➕

On the other hand, if the company has less cash at the end than at the beginning of the period, it has negative cash flow. ➖

Creative Takeaways

- Track cash flow – Know your inflows & outflows.

- Plan for taxes – Set aside funds for VAT & Self-Assessment.

- Manage irregular income – Avoid cash shortages.

- Secure funding – Essential for loans & grants.

Table of contents

1. Why is a cash flow statement important?

A cash flow statement is important because it gives you a clear picture of a business’s financial health.

A cash flow statement focuses purely on actual cash transactions – it doesn’t look at non-cash items like a profit and loss statement. This way, your business can evaluate whether it has enough funds to cover day-to-day expenses, pay employees, and invest in growth opportunities.

Cash flow statement for creatives

The statements of cash flow are crucial for freelancers and creative individuals?

Why?

Creatives often experience irregular income – one huge payment coming in in January, then nothing for months… A statement of cash flow helps creatives anticipate financially slow periods.

Regularly reviewing cash flow helps you plan to prevent situations where you struggle to pay rent, software subscriptions, or tax bills. If you check on your cash flow, you can avoid unnecessary debt.

Cash flow statement for tax planning

Tax planning is another reason why having a good cash flow management matters.

Business owners must be prepared for VAT payments, Self-Assessment tax bills or Corporation Tax as a limited company.

A cash flow statement helps these businesses set aside the right amount of money in advance – so you don’t have to worry about upcoming tax deadlines.

Cash flow statement to secure funding

Not to speak about funding – in the form of bank loans, investors or government grants.

To use these opportunities, you often have to present a cash flow statement. The lenders and investors want to see that a business has a stable financial foundation and can manage its cash effectively.

Without a good statement, even a profitable business can struggle to survive if it runs out of available funds at the wrong time.

2. Different types of cash flows

There are three main types of cash flows:

- Operating Cash Flow (OCF)

- Investing Cash Flow (ICF)

- Financial Cash Flow (FCF)

Their names immediately tell you what they are about, but let’s get into the details!

Operating Cash Flow (OCF)

This is the cash generated or used by a business’s day-to-day activities (providing services, selling products, covering regular expenses). It shows how much cash a business is bringing in from its core operations.

- Examples: Payments from clients, sales revenue, royalties, and licensing fees.

- Expenses included: Rent, salaries, software subscriptions, marketing costs, and taxes.

Investing Cash Flow (ICF)

This refers to cash spent on or received from buying and selling long-term assets (equipment, property, investments). For creative professionals, this could involve purchasing new cameras, software, or studio space.

- Examples of cash outflow: Buying new filming equipment, upgrading computers, or acquiring a creative studio.

- Examples of cash inflow: Selling old equipment, receiving money from selling investments, or earning from asset sales.

Financing Cash Flow (FCF)

This tracks cash movements related to funding a business (loans, grants, investor contributions, dividend payments). It shows how a business is being funded and whether it is taking on debt or receiving outside investment.

- Examples of cash inflow: Taking out a business loan, receiving a grant, or selling shares.

- Examples of cash outflow: Repaying a loan, paying dividends to shareholders, or buying back shares.

A business with strong operating cash flow is generally financially healthy, but a negative cash flow in investing or financing can indicate expansion, new investments, or debt repayments.

3. Cash flow statement structure

The structure of cash flow statement follows a standard format broken down into three key sections.

Cash flow from Operating Activities

The operating activities section records the cash generated or spent from a company’s core business activities. It is focuses on cash inflows from customers and cash outflows related to everyday expenses.

Cash flow from Investing Activities

This section records all the cash movement related to buying or selling long-term assets listed previously in ICF. Investing activities show how much a business is spending on future growth or earning from selling assets.

Cash flow from Financing Activities

The financing activities are all connected to the cash flow related to funding the business. This part shows if a business is taking on debt, repaying obligations, or distributing profits.

4. Benefits of using a cash flow statement

A cash flow statement is a powerful financial tool that offers several benefits, especially for creative professionals, freelancers, and businesses in the UK.

Tracks liquidity & financial health

Unlike a profit and loss statement, which includes non-cash items like depreciation, a cash flow statement focuses on actual cash movement. This helps businesses and freelancers understand if they have enough liquidity to cover expenses like rent, equipment, or payroll.

Prevents cash shortages

For creatives who experience irregular income, a cash flow statement helps anticipate when cash might be tight. This allows for better budgeting and financial planning.

Helps with tax planning

In the UK, tax bills (like Self-Assessment, VAT, and Corporation Tax) can be significant cash outflows. A well-maintained cash flow statement helps businesses set aside funds for tax payments, avoiding last-minute scrambles or an encounter with HMRC new penalty regime.

Supports loan & investment decisions

If you need business financing – through a bank loan, investor funding, or a government grant – lenders and investors will require a cash flow statement. It proves financial stability and shows whether your business can repay loans or offer a return on investment.

Aids better business decisions

By analysing cash inflows and outflows, you can make informed choices:

- Delaying large purchases until cash flow improves.

- Identifying which projects or clients generate the most steady income.

- Adjusting payment terms to avoid cash flow crunches.

Improves expense management

A cash flow statement highlights where money is going, right?! This makes it easier to identify unnecessary expenses or areas where you can cut costs – vital for businesses running on tight margins.

Helps with VAT & international sales

For UK creatives selling digital products, services, or licensing work internationally, VAT rules can be complex. Tracking your cash flow helps you have enough set aside for VAT returns, and it helps manage cash from cross-border transactions.

Essential for scaling a creative business

All of the previous benefits lead to this one.

Moving from being a freelancer to a limited company or a creative studio expanding operations, a structured cash flow helps you hire staff, invest in new equipment or take on new projects.

All of this without a financial strain.

5. Take control of your cash flow with our guidance

The bottom line is that a cash flow statement is a valuable measure of strength, profitability and long term future outlook for a company.

It can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use also use a statement to predict future cash flow, which helps with the matters of budgeting.

Keeping track of cash flow is essential for creatives, but it can get overwhelming. From irregular income to tax planning, staying on top of your finances isn’t always easy.

If you’re feeling lost, we’re here to help! Let’s simplify your finances so you can focus on what you do best. Book your free call now, and let us show you a cash flow statement template.