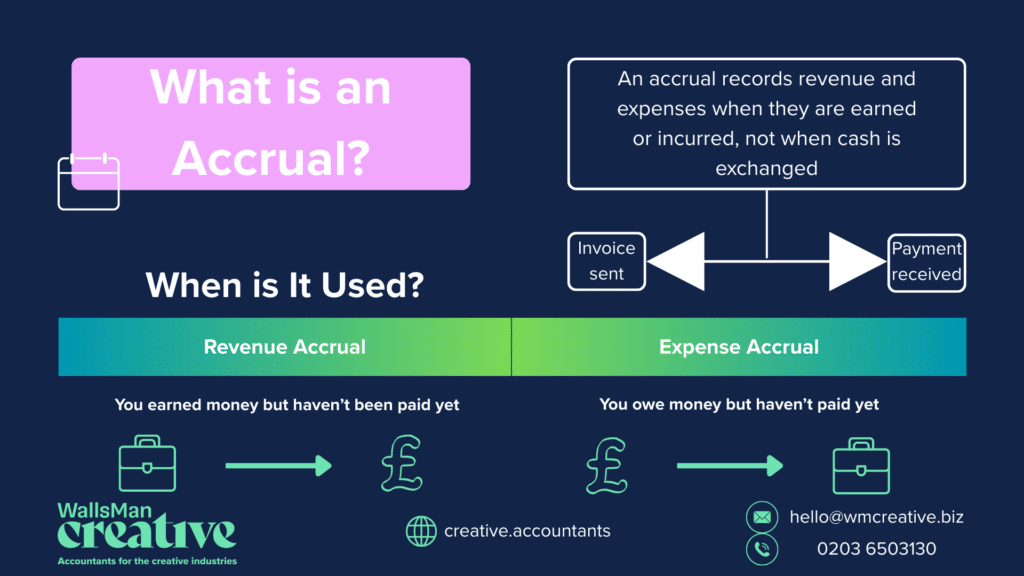

An accrual is income earned or expenses incurred that haven’t yet been received or paid.

In accounting, it ensures financial records reflect actual business activities, not just cash transactions. Let’s say, if a freelancer completes a project in March but gets paid in April, the income is recorded in March under accrual accounting.

This helps businesses track finances accurately, even if cash flow timing differs.

Creative Takeaways

- Accruals are income or expenses recorded when earned or incurred, not when cash changes hands.

- Accrual accounting offers a more accurate financial picture by aligning income and expenses with the time they relate to, rather than when payment is made.

- Accrued revenue is income earned but not yet received.

- Accrued expenses are costs incurred but not yet paid.

- Accrual accounting is beneficial for creatives with irregular income, projects, and long-term contracts, helping track true profitability.

Table of contents

1. Difference between accrual accounting vs cash accounting

There are different accounting methods used, and these methods matter a lot, especially for creatives with irregular income.

Here’s how these accounting methods differ:

Accrual accounting method

An accrual is an accounting method where revenue or expenses are recorded when the delivery of the product or service occurs rather than when payment is received or made.

It does depend on what method you use for your accounts but most accountants will use accruals when compiling your year-end accounts.

It ignores the date of the cash transaction and looks at what was done and when, so that the accounts represent a more realistic view of what is happening.

The accrual accounting method:

- Provides a clearer financial picture.

- Helps businesses with contracts, projects, and long-term payments.

- Requires careful bookkeeping to track transactions properly.

Cash accounting method

The cash accounting method is a straight accounting approach in which income and expenses are recorded only when actual cash is received and paid.

The cash accounting period is:

- Simpler and easier to manage.

- Ideal for small businesses or freelancers with straightforward finances.

- Doesn’t reflect outstanding invoices or unpaid expenses.

If you’re interested in more details about cash vs accrual, take a look at our in-depth article:

2. Types of accruals: revenue vs expense

There are two main types of accruals in accounting:

Accrued revenue (income earned but not received)

When you deliver a service or product but haven’t been paid yet.

For example, when agraphic designer finishes a website project in April but won’t receive payment until June.

Accrued expenses (costs incurred but not paid)

When you owe money for services or expenses but haven’t paid yet.

It could be a scenario where a musician rents studio space in February but receives the invoice in March.

3. How accrual accounting works: examples

Creative businesses typically operate within a financial landscape characterised by projects, contracts, and irregular income streams.

All of this makes financial tracking a bit challenging.

Accrual accounting is your way of making sure your books match what’s actually happening in your business: whether or not money has physically moved in or out of your account.

This accounting method brings some benefits for creative entrepreneurs.

Example of accruals (revenue)

Let’s say you’re a freelance designer working on a branding project.

You’ve completed the work in March, but the £2000 payment won’t arrive until April 15. You also have an outstanding expense of £500 for a design software subscription, which you used in March but will be billed in April.

Your records first show this:

| Income | 0 |

| Expenses | 500 |

| Profit | -500 |

After an accrual is added:

| Income | 2000 |

| Expenses | 500 |

| Profit | 1500 |

Example of accruals (expenses)

Your year-end is 31 December.

You have designed an amazing ad campaign for a client and agreed to get some of the items printed for them as they need it all before Christmas.

You have ordered them from your printer contact, and he has costed it at £1,600. He said, he will add it to the bill he is sending you next month – in January. The artwork comes, and you hand it over to the client mid-December, they love it and they pay your invoice for the work – £12000.

If you look to see how profitable this job was without an expense accrual you will get a misleading result.

Without an expense accrual:

| Income | 12000 |

| Expenses | 7500 |

| Profit | 4500 |

After an accrual is added they show this:

| Income | 12000 |

| Expenses | 9100 (7500+1600) |

| Profit | 2900 |

4. How to implement accrual accounting in your creative business

Accrual accounting isn’t just accountant-speak – it’s your ticket to seeing your creative business’s true financial story. You can make smarter decisions based on reality, not just when cash moves. That’s why it’s important to record income when earned and expensed when incurred.

Ready to transform your financial clarity?

Establish consistent tracking procedures, and don’t hesitate to get expert help! The initial learning curve pays off quickly with insights that will transform how you price projects, manage cash flow, and build sustainability.

Your creative brilliance deserves financial systems that match. You can make the switch today – your future self will thank you.