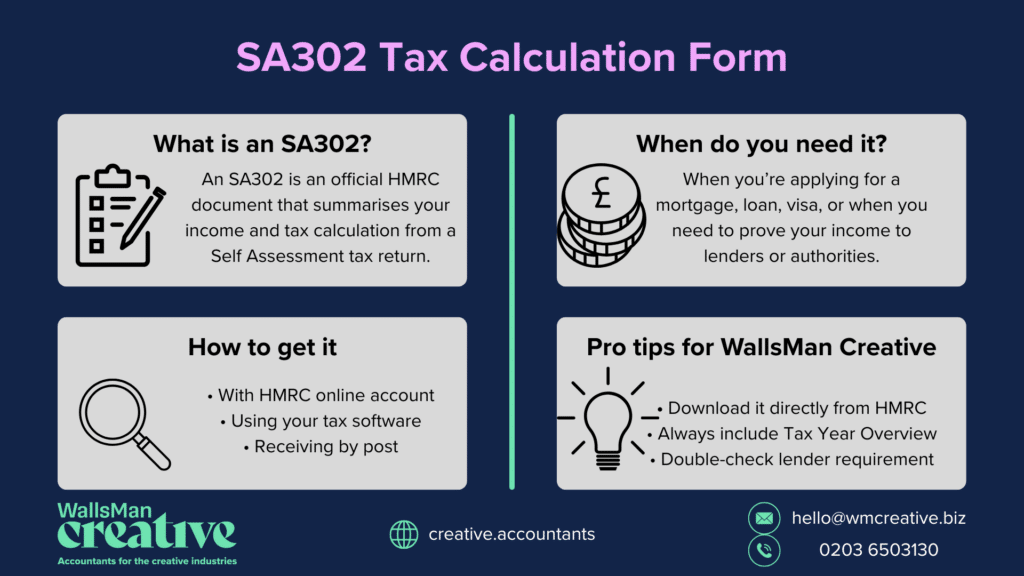

The SA302 form is a document provided by HMRC that outlines a person’s tax calculation for a given tax year. It serves as a summary of income reported through a Self Assessment tax return, detailing how HMRC has worked out the amount of tax owed.

For sole traders or freelancers paying themselves outside PAYE, an SA302 certificate is the only way mortgage lenders will verify income, and you can use it as a proof of earnings when applying for business loan or other financial products.

Creative Takeaways

- The SA302 form is an official document from HMRC summarising your Self Assessment tax calculation for a tax year.

- SA302 serves as proof of income for self-employed individuals and is often required by mortgage lenders and business loan providers.

- You can download your SA302 online through your HMRC account if you filed online, or request it by post if you filed a paper return.

- The SA302 is different from the Tax Year Overview, which confirms the tax paid to HMRC; lenders usually require both.

- Most mortgage lenders accept a self-printed SA302 downloaded from HMRC.

Table of contents

1. What information does the SA302 include?

An SA302 form contains a breakdown of key financial details:

- Total taxable income – This includes income from self-employment, rental properties, dividends, pensions, and any other sources reported to HMRC.

- Taxable allowances and reliefs – These include adjustments such as the personal allowance and tax reliefs that reduce the amount of tax owed.

- Tax payable – The amount of tax due for the tax year, based on the income reported.

- Tax paid – Any payments already made towards the tax bill.

- Outstanding tax liabilities – Any unpaid amounts that still need to be settled.

This information helps both self-employed individuals and lenders see a clear summary of taxable income and payments.

2. Why do you need an SA302 tax calculation?

There are several situations where someone might need an SA302:

- Applying for a mortgage – Most mortgage lenders request SA302 forms for at least two years to confirm a person’s earnings.

- Applying for a business loan – Lenders often require proof of income history before approving financial support.

- Visa or financial applications – Some government and financial institutions require documented proof of income.

- Providing tax details to an accountant – Having anSA302 tax calculation helps with financial planning and reviewing past tax years.

Many lenders will request both the SA302 tax calculation and a Tax Year Overview, which confirms the total amount of tax paid to HMRC. But…

3. Is the SA302 the same as tax year overview?

Many mortgage lenders and financial institutions request both an SA302 tax calculation and a Tax Year Overview.

But keep in mind, that these documents are different and they provide different details:

- SA302 – Shows a breakdown of taxable income, deductions, and the amount of tax calculated.

- Tax Year Overview – Confirms how much tax has been paid to HMRC for that tax year.

When applying for a mortgage, both documents are usually required.

4. How to get an SA302 tax calculation form?

If you file your tax return with HMRC, using HMRC’s online services website, this can be easily obtained from your government gateway account. You just need to log in, go to your self-assessment account and download the document.

👉 Get your SA302 tax calculation via HMRC

If you have an accountant or you used an accounting software, it’s a bit different. And then there’s a chance when you ca Let’s break it down:

If you filed online via HMRC

For those who completed their Self Assessment tax return online, the SA302 tax calculation can be accessed by following these steps:

- Log in to your HMRC online account.

- Select ‘Self Assessment’ from the main menu.

- Click ‘More Self Assessment details’.

- Choose the relevant tax year and select ‘SA302 tax calculation’.

- Click ‘Download and print’ to get a copy of your tax calculation.

The document will be available for up to four tax years after submission.

If you used accounting software

If you have an accountant who files your tax return for you, they will be able to provide you with a copy of your SA302 at the click of a button.

When the Self Assessment tax return was submitted through commercial accounting software, the SA302 must be downloaded directly from the software. The document may appear under different names:

- Tax computation

- Self Assessment summary

- Copy of your tax calculation

The steps for accessing it will be different depending on the software used.

If you filed a paper tax return

For those who submitted a paper tax return, HMRC will send a copy of the SA302 form by post automatically. If it has not arrived, a request can be made by calling the HMRC Self Assessment helpline.

If a Self Assessment tax return was only recently submitted, it can take up to 72 hours before the SA302 becomes available to download.

5. Do mortgage lenders accept a self-printed SA302?

Most mortgage lenders accept SA302 tax calculations that are downloaded and printed from HMRC online services.

Some mortgage lenders still require original versions sent directly from HMRC.

To check whether a lender will accept a self-printed SA302, refer to HMRC’s list of approved lenders. If a lender does not accept a digital copy, an official SA302 document may need to be requested from HMRC by post.

Some lenders may also ask for additional proof, such as bank statements or accountant-certified income reports, to support a mortgage application.

6. How to get a copy of SA302 form – with WallsMan Creative

Are you tired of wasting precious creative energy on complicated tax forms? We get it – your talent belongs in your art, not buried in accounting headaches.

Why struggle alone when we can help you right now?

With just one click, we’ll instantly retrieve your SA302 and tax overview. But we don’t just hand over documents – we’ll walk you through exactly what everything means in plain English.

Imagine what you could create with all that time and mental space back!

Book your FREE consultation today! Let’s talk about how we can handle the numbers while you focus on what you do best.