R&D stands for Research and Development (R&D). R&D Tax Relief is a government program that helps UK businesses reduce their Corporation Tax. Businesses can also claim cash credits if they invest in innovation.

Research and Development applies to projects that promote science or technology. The creative industry is pushing creative and technological boundaries, so the creative sector can also use R&D tax relief.

Game development, animation, and digital production all fall into this category. Keep in mind: you have to prove that you’re advancing in the field of science or technology, so it’s not easy to pass. That’s why most film and animation production companies will apply for film tax credits, while gaming companies will apply for video game tax credits.

HMRC has a detailed guideline on how you have to describe your project.

There are different categories for R&D tax relief. Most creatives will be interested in the scheme for small and medium-sized businesses (SMEs).

Creative Takeaways

- Maximise R&D tax relief – Reduce tax or claim credits.

- SME eligibility – Meet staff & turnover criteria.

- Merged scheme – Simplified claim process.

- ERIS support – Extra relief for R&D-intensive SMEs.

- Record-keeping – Essential for compliance.

Table of contents

1. What is R&D Tax Relief?

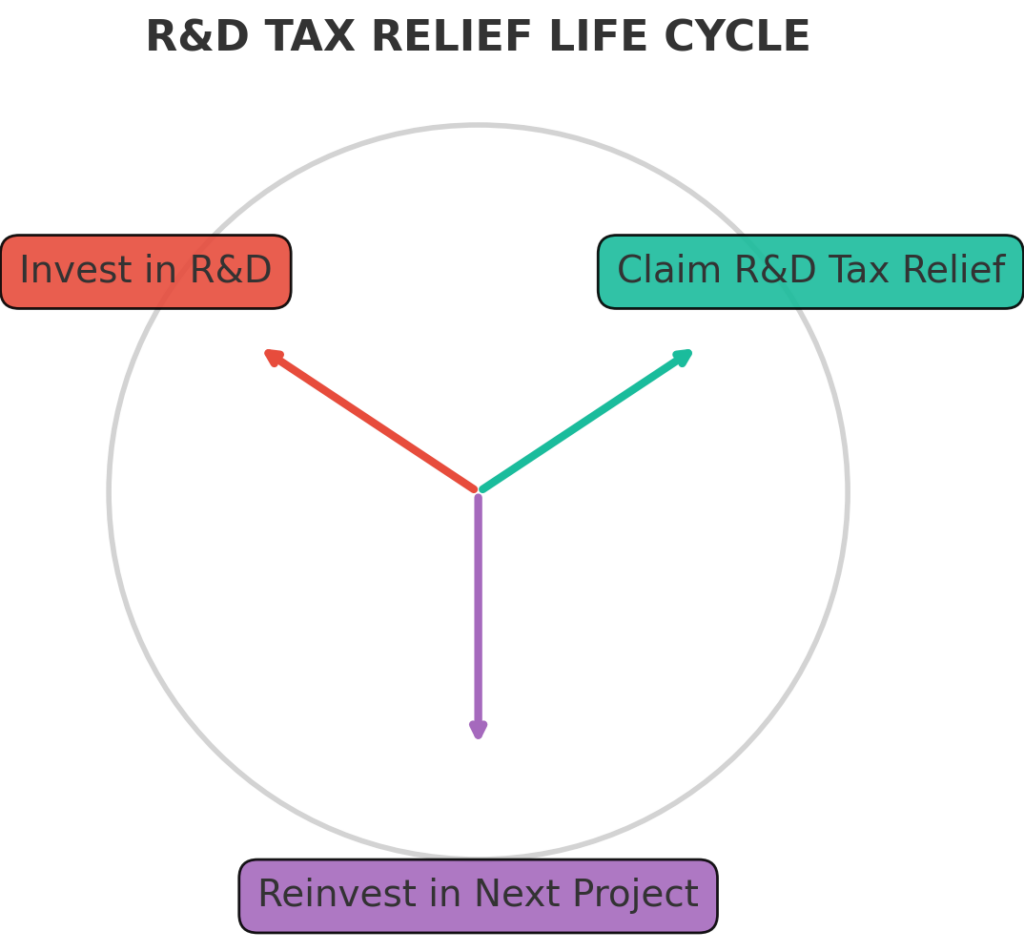

R&D (Research and Development) Tax Relief is a UK government incentive. It encourages companies to invest in innovation by offering tax reductions. It can also come in the form of cash credits – if companies qualify for R&D activities.

The government introduced R&D Tax relief in 2000 to support SMEs. In 2013, the government created a different scheme for larger companies called the Research and Development Expenditure Credit (RDEC).

Today, the SME and RDEC schemes are merged into a single scheme.

In most cases, Research and Development applies to small, medium-sized businesses or larger companies working to advance science and technology by overcoming technical uncertainties.

The goal is to simplify claims, reduce tax fraud and to ensure relief is targeted towards real R&D activities.

The good thing about R&D tax relief is that it applies to projects even if they don’t succeed.

2. What are R&D sectors?

Research and Development Tax relief can be applies to several businesses. How do you know if you part of the R&D sector?

R&D tax relief is used by businesses in any industry as long as they have projects that advance science and technology. Creative and digital industries also fall into this category.

Creative & Digital Industries

- Video game development

- Animation and visual effects (VFX)

- Film, TV, and media production

- Digital design and interactive technology

- Augmented reality (AR) and virtual reality (VR)

Software & Technology

- Artificial Intelligence (AI) and machine learning

- Cybersecurity development

- Blockchain and cryptocurrency technologies

- SaaS (Software as a Service) solutions

Life Sciences & Healthcare

- Pharmaceuticals and biotechnology

- Gene therapy and diagnostic tools

- Health tech innovations

Green Energy & Sustainability

- Renewable energy solutions (solar, wind, hydrogen, etc.)

- Sustainable packaging and materials

- Energy-efficient processes

Construction & Architecture

- Smart building technologies

- Digital twin and BIM (Building Information Modelling)

Manufacturing & Engineering

- Advanced materials and composites

- Robotics and automation

- Aerospace and automotive innovations

- Sustainable manufacturing processes

3. Can you claim R&D tax credit?

You need to meet several key criteria to be eligible for R&D tax credit:

- Your business must be liable for UK Corporation Tax

- Your project should aim to make a genuine advance in science or technology

- R&D activities should be planned

- You have to develop or improve products, processes, or services

- Some of your costs are eligible for R&D Tax Relief (staff wages, NICs, materials used in the process etc.)

- You have to keep detailed records of R&D activities and expenditures

If your business meets these conditions, you may be eligible to claim tax relief or cash credits. You can check the Government’s official website for R&D tax relief criterias.

4. Different types of R&D Tax Relief Schemes

As of 1 April 2024, the UK government restructured the R&D Tax Relief system. The new Merged Scheme offers 20% taxable expenditure credit on qualifying R&D projects.

The Enhanced R&D Intensive Support (ERIS) provides extra assistance to loss-making SMEs invested in R&D. To claim ERIS, your company’s expenditure must constitute of at least 30% of its total expenses.

Eligible companies can deduct additional 86% of their qualifying R&D costs, which totals 186% deduction. You may also claim a payable tax credit worth up to 14.5% of the surrenderable loss.

Here is an overview table of the different R&D Tax Relief structures:

| Business Type | Eligibility Criteria | Available Relief |

|---|---|---|

| All Companies | Subject to UK Corporation Tax and engaged in qualifying R&D projects | 20% taxable expenditure credit under the Merged Scheme |

| Loss-Making SME | Fewer than 500 staff, turnover ≤ £100 million or balance sheet ≤ £86 million, and R&D expenditure ≥ 30% of total expenses | Enhanced R&D Intensive Support (ERIS): Additional 86% deduction (total 186%) and up to 14.5% payable tax credit |

| Profit-Making SME | Fewer than 500 staff, turnover ≤ £100 million or balance sheet ≤ £86 million, and engaged in R&D | 20% taxable expenditure credit under the Merged Scheme |

| Large Company | 500+ staff or exceeding SME financial thresholds, engaged in R&D activities | 20% taxable expenditure credit under the Merged Scheme |

5. How to apply for R&D credit SME scheme

You have to follow 5 steps to apply for R&D Tax Relief as a Small or Medium-sized Enterprise.

Determine eligibility

You have to make sure your company qualifies as an SME. This typically means fewer than 500 employees, a turnover less than £100 million or a balance sheet total under £86 million.

You have to confirm that your project’s goal is to advance scientific or technological ideas.

Notify HMRC

You must inform HMRC of your intention to claim R&D Tax Relief. This notification should be submitted within six months of the end of the relevant accounting period.

Prepare and submit claim

You need to complete the additional information form detailing your R&D activities and associated costs. This has become mandatory for accounting periods starting on or after 1 April 2023.

You also have to incorporate your R&D tax relief claim into your Company Tax Return for the given accounting period.

Consider Advance Assurance

If you are applying for your first R&D tax relief claim, you may apply for Advance Assurance.

HMRC will accept your claims for the first three accounting periods – provided that your projects are aligned with the details submitted.

Keep your records

With R&D tax relief claims, it is more important than ever to keep detailed records of your R&D projects.

Have every document for project descriptions, objectives, challenges faced, and expenditures saved and stored in a safe space. The documentation supports your claim and is essential in case of HMRC inquiries.

6. The benefits of R&D tax relief

R&D Tax Relief is a valuable financial boost for SMEs and creative businesses investing in innovation.

It doesn’t matter if you’re developing new tech, animation, video games, or you offer digital solutions. This tax relief can cut tax bills or provide cash reliefs to help you fund further growth.

With the new merged scheme and Enhanced R&D Intensive Support (ERIS), businesses – especially R&D-heavy SMEs – can access even greater financial benefits. But HMRC’s stricter rules mean proper record-keeping and accurate claims are essential.

If you need help figuring out if you qualify, how to apply, or managing your record, we can guide you.

We’ll help you get through the process – so get in touch today!