Personal tax year vs Company tax year

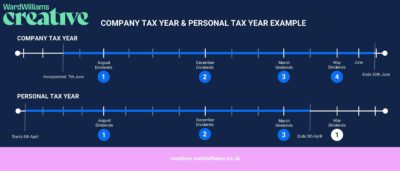

As a director you submit a personal tax return which runs in line with the financial tax year of the UK from April 6th to April 5th each year.

When you set up a Company its financial year runs 12 months from the month it was set up, so for example if you set up a company on 7th June, then the financial and tax year of the Company would always run to 30th June each year

If the Company paid you 4 dividends in the year, say in August, December, March and May, all of those would be reported in the Company year to the end of June.

However, in your personal tax return the payments in August, December and March would fall into one tax year and the May payment would fall into the next personal tax year, as the distribution was dated after the 5th April tax year end.

When planning your earnings and the tax you will pay, accountants look at the different tax years in play to see if they can help you split tax into the most efficient periods.

It is possible to move your company year end to 31st March to bring it in line with your personal tax return, eliminating the 2 different tax years and everything happens in the same tax year.

For some people it can be confusing and so they would rather not have 2 different year ends.

Others prefer to have 2 years overlapping to have maximum tax planning opportunities.

It’s a choice. If you are unsure or want to make a change then you can speak to your accountant…. or us!